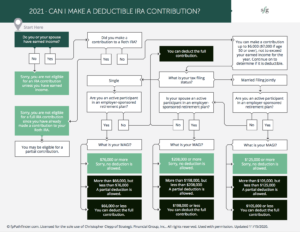

Oftentimes, I have many clients come to me and ask, “Can I make a deductible Traditional IRA contribution?” Since this is a common question, I decided to tackle it in this week’s blog post. The following will provide you insights on whether you can or cannot make a deductible Traditional IRA contribution.

The first question to ask is, do you or your spouse have any earned income? If the answer is a quick “no”, then you will not be eligible for a Traditional IRA contribution. However, if the answer is “yes” and you did not already contribute money to a Roth IRA, then you can contribute up to $6,000 to the Traditional IRA, $7,000 if you are over the age of 50. It is important that this contribution does not exceed your earned income for the year.

Our next step is to determine if the contribution is deductible.

We next need to ask, what is your tax filing status? If you are married, filing jointly, and you and your spouse are active participants in an employer-sponsored retirement plan, there will be some ramifications. If you are an active participant in an employer-sponsored retirement plan and your MAGI (Modified Adjusted Gross Income) is $125,000 or more, then no deduction is allowed. If your MAGI is more than $105,000 but less than $125,000, then a partial deduction is allowed. A full contribution is only allowed if your MAGI is $105,000 or less when filing jointly.

Let’s say that only your spouse is an active participant in an employer-sponsored retirement plan. In that case, if your MAGI is $208,000 or more, then no deduction will be allowed. A partial deduction is only allowed in this scenario if your MAGI is more than $198,000 but less than $208,000. Finally, the only way to get a full deduction in this scenario is if your MAGI is $198,000 or less.

It is also important to note, that a full deduction is possible if neither you nor your spouse are active participants in an employer-sponsored retirement plan.

Now, if you’re filing your taxes as someone who is single, there are different criteria that need to be followed. If you are single and an active participant in an employer-sponsored retirement plan, then it is important to know your MAGI. If your specific MAGI is $76,000 or more, then you will not be allowed a deduction. If your MAGI is more than $66,000 but less than $76,000, then you are allowed a partial deduction. The only way to receive a full deduction when filing as a single person is when your MAGI is $66,000 or less or if you are not an active participant in an employer-sponsored retirement plan.

I hope that this has made it easier to understand whether you can make a deductible contribution to a Traditional IRA. Contribution limits and MAGI income limits are based on the 2021 tax year.

Because the IRS has pushed back the filing deadline to May 15th this year you may still be eligible to contribute for your 2020 tax year. This could reduce the taxes you pay for 2020. If you would like to review your situation please set up a time to talk HERE.