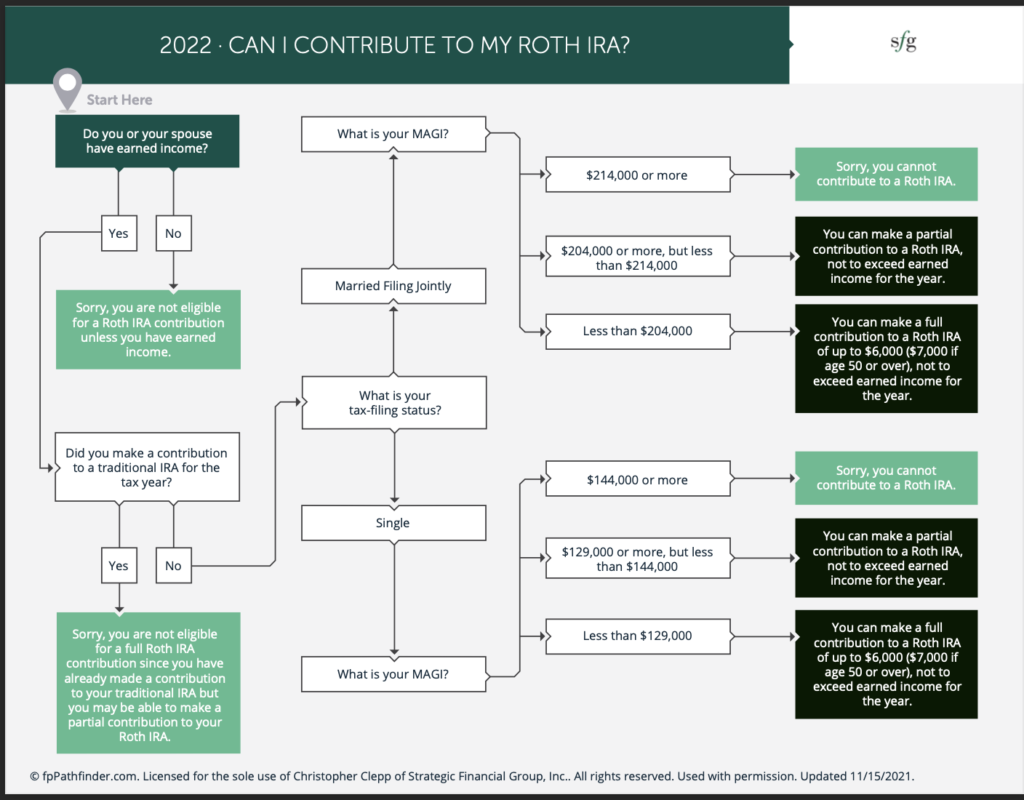

A question that often comes up is, can I contribute to a Roth IRA? There is still time to contribute in 2022 IF you qualify. I am going to walk you through the steps of whether you qualify.

First, do you have an earned income?

- If you don’t have an earned income, you cannot make a Roth IRA contribution.

- If you do have earned income, then yes, you may be eligible to contribute to a Roth IRA.

- However, if you have earned income, and you contributed to a Traditional IRA for the tax year, you are not eligible for full Roth IRA contributions since you have already contributed to your Traditional IRA. You may be able to make a partial contribution to your Roth IRA. Typically, you will have to choose which one you’re going to contribute to if you’re going to max it out in a single year. So, you have $6,000 contribution limit, $7,000 if you’re over the age of 50, that you can contribute between a Traditional IRA and a Roth IRA, so choose wisely.

Let us assume that you do have earned income, and you did not contribute to a Traditional IRA.

- If you are single and make less than $129,000 of modified adjusted gross income or MAGI, you can make a full contribution to the Roth IRA of $6,000, $7,000 if you’re over the age of 50, not to exceed your earned income for the year.

- Now if you earn between $129,000 and less than $144,000 modified adjusted gross income, you can make a partial contribution to your Roth IRA, not to exceed your earned income for the year.

- If you are single and your modified adjusted gross income is $144,000 or more, you cannot contribute to a Roth IRA.

What about if instead of being single, you are married filing jointly,

- If your household modified adjusted gross income is less than $204,000, you can make a full contribution to a Roth IRA, up to $6,000, $7,000 if you’re over the age of 50, not to exceed your earned income for the year.

- If your income is between $204,000 and less than $214,000, you can make a partial contribution to a Roth IRA not to exceed your income for the year.

- If you make $214,000 or more, sorry, you cannot contribute to a Roth IRA.

I hope this has been helpful to you and understanding whether or not you can contribute to a Roth IRA, please reach out to me with any questions. Contribution limits and MAGI income limits are based on the 2022 tax year.