“There are only 3 edges in the market.

You can be smarter than everyone else.

You can be luckier than everyone else.

You can be more patient than everyone else.

What’s your edge right here, right now?”

-Morgan Housel

I don’t usually repeat quotes, but I feel this one is appropriate today.

The coronavirus continues to spread and the tone in the United States, and all over the world, has shifted sharply over the last 24 hours. In a very eventful day, the World Health Organization declared the coronavirus a global pandemic, Italy took major action, and financial markets took a big hit.

I am not going to rehash what I am sure you have already heard or read about regarding the markets and the postponing of events over the last few days. You know all of that already. The real question is, “what happens next?”

Let’s get that out of the way right now. No one knows. Yes, there are those that say 100 million Americans will get the coronavirus and hundreds of thousands will die. There are those who think a few thousand people will die and that this will all be a distant memory in just a few months. And, of course, there are the hundreds of scenarios in between.

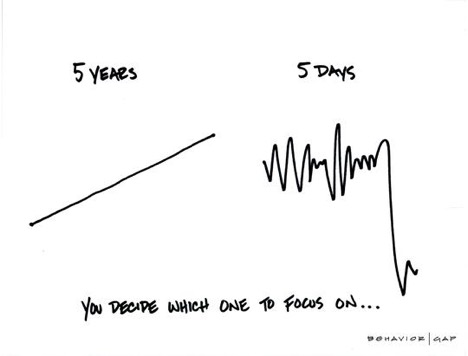

But, here’s the thing when it comes to investing. If you know for certain things will get much worse, and that you can tell ahead of time when things will get much better, then you should go to cash and reinvest at that point. Now, I’ve been doing this for a while, I have never seen people be able to actually do it. Warren Buffet and the late great John Bogle, two of the greatest investors in history, repeatedly said they never met someone who could successfully time the market. So, when it comes to investing and you don’t know with certainty what is going to happen, you stay invested. I know we will be sitting here 6-12 months from now and say, “Of course that’s what happened” but, hindsight is always 20/20.

If things are going to be fine, then why is the market reacting so violently? First, disruption of supply and demand means disruption of corporate earnings. Earnings will probably be down for most companies for a while. This is less of a concern than the timeline for everything to recover. In 2008, investors were concerned about the financial system recovery. After 9/11, people wondered if there would be another attack, how long before Americans stopped cocooning, and when they would return to spending their money. In a worst-case scenario, the outbreak lasts for more than a few months, kills tens of thousands or even hundreds of thousands. Companies lay off people due to a lack of demand, creating fewer consumers which will create more layoffs, and on, and on, sending us ultimately into a recession. In a best-case scenario, everyone is back to normal in a few months, the market recovers in swift fashion, and we all move on.

So, what are we to do? This may be the first COVID-19 crisis filled with uncertainty, but it is not the first market downturn created by uncertainty. In fact, there is only one thing all bear markets have in common, they come with a large dose of uncertainty.

With 9/11, many feared the economy would take years to recover. With the Greek Debt Crisis, many feared it would lead to debt defaults all over the world, resulting in a global recession. When United States treasury bonds were downgraded, many feared it would result in a lack of confidence in the United States and plummet us back into a recession. With Brexit, many feared Great Britain would collapse as a global financial center, driving Europe and with it, the world, into a recession. In each and every case, we got through it. Someone who went to cash and thought to “wait things out” got burned, missing the time to get back in (which is nearly impossible to do). Wise investors collected their dividends and waited things out. Brilliant investors continued to rebalance through the pullback. These investors generally recover faster than the market and are far better off after accounting for tax savings.

It’s been said, there are two types of soldiers in the army, those who can shoot at the range and those who can shoot when being shot at. We are the latter. We are prepared for markets like this and so are you. This is why we have a plan. This is why we have a strategy. Not for the easy up markets, but for markets like this one. Now is the time to push through it, however long and painful it may be, and come out on the other side, better off than had the market done nothing at all.

If you or someone you know is having a hard time, go back and read one of my previous newsletters that tackles “freaking out” and how to work through this feeling. It’s okay to freak out!

I will leave you with my tips to happiness for the coming weeks (still the same as before).

- Wash your hands frequently.

- Don’t touch your face.

- Stay hydrated.

- Don’t shake hands.

- Be patient.

Would you like to align your money with your goals, make smart financial decisions, and proactively manage the risks and taxes that come with business ownership and life?

That is what we help clients do.

Securities offered through The O.N. Equity Sales Company, Member FINRA/SIPC, One Financial Way Cincinnati, Ohio 45242 (513) 794-6794. Investment Advisory services offered through O.N. Investment Management Company. Estate planning services provided in conjunction with your licensed legal professional. All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.