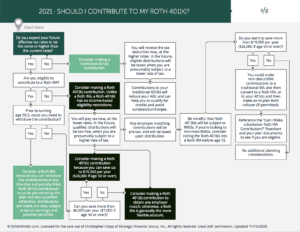

I’m going to walk through a quick process that I use to help our clients understand whether or not they should contribute to a Roth 401k.

Step 1: Do you expect your future effective tax rates to be the same or higher than the current rates? If the answer is no, then you should consider making a traditional 401k contribution. This is because you will receive the tax deduction now at higher rates, and in the future eligible deductions will be taxed when you are presumably subject to a lower tax rate. Contributions to your traditional 401k will reduce your adjusted gross income and can help you to qualify for credits and avoid surtaxes or surcharges.

Step 2: Are you eligible to contribute to a Roth IRA? If you look at my previous posts about qualifying for a Roth IRA HERE and HERE, this will help you answer that question.

If the answer is no, then you should consider making a Roth 401k contribution. Because unlike a Roth IRA, a Roth 401k has no income-based eligibility restrictions. Again, you will pay taxes now at the lower rates and the future qualified distributions will be tax free when you are presumably subject to a higher rate of tax.

Any employer matching contributions will be pretax and will be taxed upon distribution. Be mindful that Roth 401k’s will be subject to a required minimum distribution, or if you’re looking to minimize required minimum distributions consider rolling the Roth 401k into a Roth IRA before the age of 72.

If you are eligible to contribute to a Roth IRA consider whether you could need to make a withdrawal before age 59.5

If the answer is yes, consider a Roth IRA because you can withdraw the contributions at any time tax and penalty free. Roth 401k withdrawals must be permitted by the plan and also qualified otherwise. Distributions are made pro rata subject to tax on earnings and possible penalties.

If the answer is no, you won’t need to withdraw the contribution, the question then becomes, can you save more than $6,000 per year, $7,000 over the age of 50.

If the answer is no, considering making a Roth 401k contribution to obtain any employer match, otherwise a Roth IRA is generally the more flexible account.

If you want to save more than that $6,000 per year, $7,000 if over the age of 50, you should consider making a Roth 401k contribution because you can save up to 19,500 per year, $26,000 at age 50 or over. You will also pay taxes now at the lower rates, and in the future qualified distributions will be tax-free when you’re presumably hired, subject to a higher tax rate.

Lastly, do you want to save more than that 19,500 per year, $26,000 if you’re over the age of 50. If the answer is yes, you can make nondeductible contributions to a Traditional IRA and then convert it to a Roth IRA or to your 401k and then make an in-plan Roth rollover, if this is permitted within your plan.

As you can see, there are a lot of considerations that need to be taken into mind before making a Roth 401k contribution. If I can be of any assistance, please feel free to reach out.