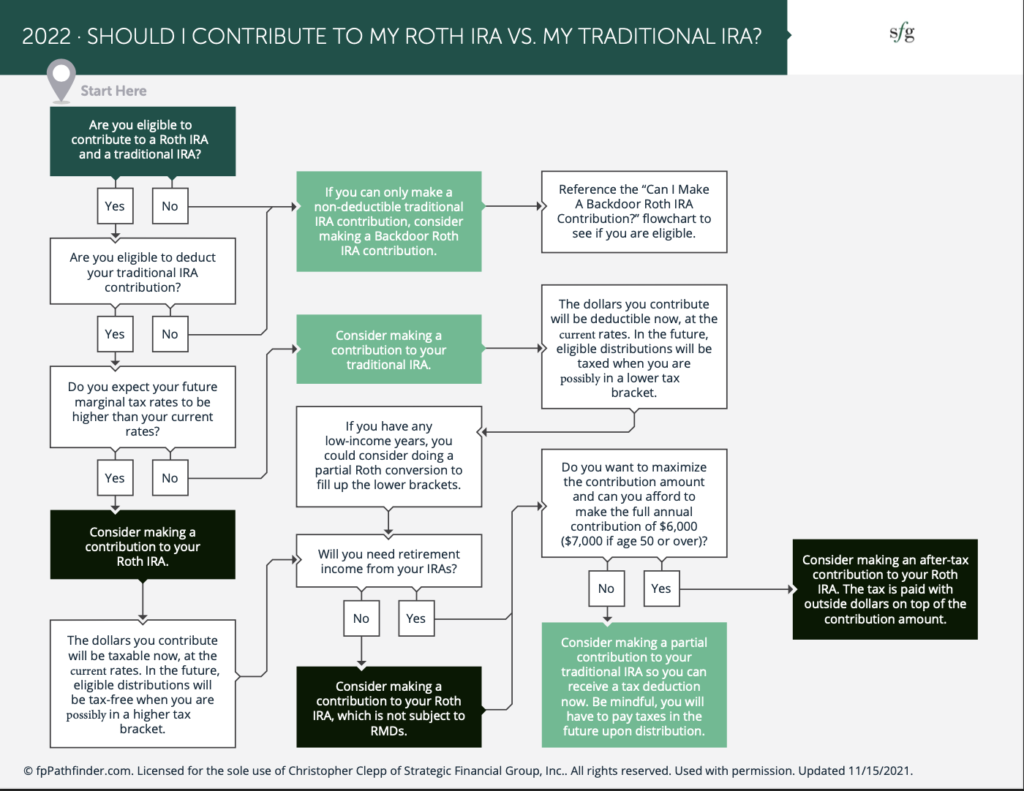

A question that pops up often is “Should my contributions go to my traditional IRA or my Roth IRA?” We’re going to look at how we go about this process in this week’s Inside Look at Building Toward Wealth.

You are still able to make contributions for 2021 until April 18th. If you need help reviewing your eligibility for 2021 contributions, please reach out to me.

When considering the question of Roth vs Traditional IRA, the first thing to know is whether you are eligible to contribute to a Roth or make deductible contributions to a traditional IRA. The Roth IRA and the deductible traditional IRA both have income phase-out limits.

Roth IRA contributions are never tax-deductible, and you must meet certain income requirements to make contributions.

If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $144,000 for the tax year 2022 to contribute to a Roth IRA and you will not be able to contribute the full amount if you make between $129,000 and $144,000.

If you’re married and file jointly, your MAGI must be under 214,000 for the tax year 2022, and you will not be able to contribute the full amount if you make between $204,000 and $214,000.

The maximum total annual per person contribution for all your IRAs combined is $6,000 if you are under age 50 and $7,000 for those age 50 and over.

If you are ineligible to make a tax-deductible contribution to a traditional IRA and you cannot make a contribution to a ROTH IRA, you could consider making a nondeductible traditional IRA contribution and then make a backdoor Roth IRA contribution.

What would make you ineligible for a tax-deductible contribution? Can I make a deductible traditional IRA contribution?

- If you have no retirement plan at work, you can put money in (up to the annual contribution limit) and deduct the entire amount from your taxes. (If your spouse doesn’t work outside the home, he or she can also invest up to the federal limit and deduct the full amount.)

- If you do have a 401(k) or other retirement plan at work, your contribution is fully deductible only if your modified adjusted gross income (MAGI) is $109,000 or less for a married couple filing jointly or $68,000 or less for an individual.

- If you have a workplace retirement plan, the deduction for your traditional IRA contribution is phased out completely if your MAGI is $129,000 or more (married couple filing jointly) or $78,000 or more (individual).

If you are eligible to contribute to both, the next question you need to ask yourself is, “Do you expect your future marginal tax rates to be higher than your current rates?” If the answer is no, you should consider making a contribution to your traditional IRA. The dollars you will contribute will be deductible now, at the current rates. In the future, eligible distributions will be taxed when you are possibly in a lower tax bracket.

If you have any low-income years, you could consider doing a partial Roth conversion to fill up the lower brackets.

If the answer is yes, do you expect your marginal tax rates to be higher than your current tax rates, then you should consider making a contribution to your Roth IRA. The dollars you contribute now will be taxable now, at the current rates. In the future, eligible distributions will be tax-free when you are possibly in a higher tax bracket.

Your contribution limits for any one year are $6,000, $7,000 if you’re age 50 or over in the year 2020. This is combined between the two types of IRA’s.

The next question is, “Will you need retirement income from your IRAs?”

If the answer is no, consider making a contribution to your Roth IRA, which is not subject to RMDs.

If the answer is yes then consider the question “Do you want to maximize the contribution amount and can you afford to make the full contribution of $6,000 ($7,000 if age 50 or over)?”

If that answer is yes, then consider making an after-tax contribution to your Roth IRA. The tax is paid with outside dollars on top of the contribution amount.

If that answer is no, consider making a partial contribution to your traditional IRA, so you can receive a tax deduction now. Be mindful, you will have to pay taxes in the future upon distribution

Please feel free to reach out with any questions you may have. Connect here

Have an outstanding week!

Please consult with your tax professional for additional guidance regarding tax-related matters and ask, Should I Contribute To My Roth IRA vs. My Traditional IRA?