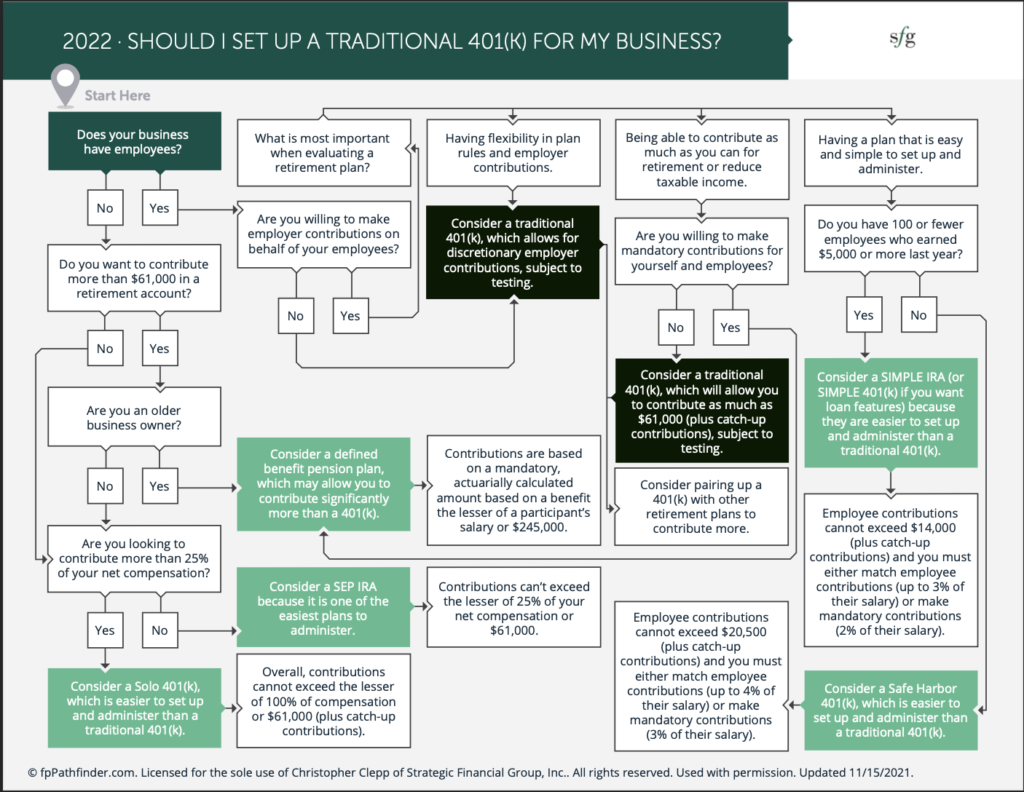

Business owners who are considering a retirement plan for their business have many options. While a traditional 401(k) is a well-known choice for business owners, there are many cases where other retirement plan options may be better suited for the business and the owner. We will take a look at which choice is best for your business in this weeks Inside Look at Building Towards Wealth.

This article considers:

- Which plans may be better when there are no employees

- When a defined benefit pension plan could be set up

- Options to review when the goal is to contribute more than $61,000 per year

- Maximum employee contribution amounts for plans

- Which plans have mandatory matching contribution requirements

- Minimum employer matching contribution amounts

- Plans that offer more flexibility

It all starts with do you have employees?

-No I don’t have employees

Do you want to contribute more than $61,000 to your retirement account. If the answer is yes and you an older business owner then consider a defined benefit pension plan. This plan could allow you contribute significantly more than a 401(k).

If you do not have employees and are not going to contribute $61,000 to your retirement account, are you looking to contribute more than 25% of your net compensation?

If you are, then you should consider a solo 401(k) which would be easier to set up than a traditional 401(k). Overall contributions cannot exceed the lesser of 100% of compensation or $61,000, plus any additional catch-up contributions.

If the answer was ‘no’ for the last question, then you should consider using a SEP IRA because it is one of the easiest plans to administer. Contributions cannot exceed the lesser of 25% of the net compensation or $61,000.

–Yes I Have employees

Are you willing to make employer contributions on the behalf of your employees? If you are then you would need to know what is most important when evaluating a retirement plan.

If you want to have flexibility in plan rules and employer contributions, then you should consider a traditional 401(k). This will allow for discretionary employer contributions. You should also consider pairing 401(k) with other retirement plans to contribute more.

If the most important requirement of your retirement plan is to contribute as much as you can for retirement or to reduce taxable income, then you need to figure out if you are willing to make mandatory contributions for yourself and your employees? If not, then you should consider a traditional 401(k), which will allow you to contribute as much as $61,000. If yes, they you should consider a defined benefit pension plan. This may allow you to contribute significantly more than a 401(k).

-I want to make it as SIMPLE as possible

If the most important requirement is to have an easy and simple set up to administer, then the question is do you have 100 or fewer employees who earned less than $5,000 or more last year? If you are under 100 employees, then you should consider a SIMPLE IRA because they are easier to set up and administer than a traditional 401(k). Employee contributions cannot exceed $14,000 and you must either match the employee contributions up to 3% of their salary or make mandatory contributions (2% of their salary).

If you do not have 100 or fewer employees who earned $5,000 or more last year, then you should consider a Safe harbor 401(k). This is easier to set up and administer than a traditional 401(k). Employee contributions cannot exceed $20,500 and they must either match employee contributions, up to 4% of their salary or make mandatory contributions (3% of their salary).

As you can see there are many choices to be made in setting up the best retirement plan for your company.

If you would like to review your situation and talk more about whether you should set up a traditional 401(k) for your business, please set up a time to talk HERE