Begin with the end in mind

-Stephen Covey

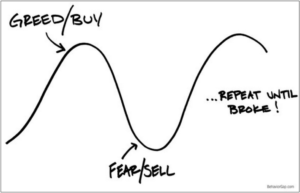

One of the most important things that you can do to help you realize your financial goals is to develop a strategy to help reach those goals and then stick to that specific strategy. It is much easier to change the course at every sign of difficulty than it is to stick with a long-term strategy through the ups and downs of the cycle. We often see people go through the cycle pictured below. This week on Inside Look at Building Towards Wealth, we will look at how to avoid this greed-fear cycle.

People watch a strategy do well and they end up getting greedy. They buy-in at the top of the market, but when that strategy has some difficulty, they get fearful and sell near the bottom. Then, they wait on the sidelines for that perfect moment to know it’s safe to invest, usually near the next stop and repeat this over and over again until broke.

We saw this type of human action in full effect several times over the last few decades. In the “Dot-com Bubble” of the late 1990s and early 2000s, more and more people started piling into the stocks of companies that were trading at valuations far larger than any of their likely profitability numbers. Then we saw a popping of that bubble. The Nasdaq composite dropped 78% from March 2000-October 2002.

Many people become fearful as the market went down and they sold their stocks, oftentimes, at or near the bottom of the market. These people did so to only sit out of the next price appreciation of over 300% from the bottom in 2002 until September of 2007.

They then began piling back into the market in 2006 and 2007 when people again got greedy. This only worked until we saw the great financial crisis of 2008. People got fearful again and sold out at the bottom of the market. Missing what would subsequently be the longest bull market in the history of the markets. From the bottom in 2002 to Jan 1 of 2021 there has been an over 1600% increase in the QQQ which is the largest Nasdaq 100 index ETF.

We have seen this pattern of behavior over and over again throughout the history of humankind. It is simply human nature to get greedy and to double down when people have lost all ability to look back into the last time there was a downturn. It is only natural for us to get fearful when we see negative reactions in the market.

These are the type of instincts that served us well when we were prey, ourselves. When we were the ones being hunted on the plains without access to modern medicine to help us recover from an animal attack.

Fear may be as old as life on Earth. It is a fundamental, deeply wired reaction, evolved over the history of biology, to protect organisms against a perceived threat to their integrity or existence. Fear may be as simple as a cringe of an antenna in a snail that is touched, or as complex as existential anxiety in a human

Our brains are not naturally equipped to deal with the ups and downs of the markets. We need to act appropriately and be able to overcome that part of our brains. It is not easy to do.

Our amygdala is the part of our brain that causes anxiety. When our amygdala lights up, we start to feel anxious. It is part of our fight or flight mechanism that hardwired into our brains. Social Media and the News are often designed to trigger this area of our brain.

It is only natural to feel anxious when the market has a downturn. It can cause us to panic and we begin to enter our fight or flight response, and that can often lead us to poor decisions. When this situation comes up, we need to have a thoughtful plan that has been laid out to help us reach success. We need to stay true to our plan. The worst time to jump out of a ship is in the middle of a storm.

This is not to say that we should not make adjustments to your plan over time. The only thing that is constant is change. However, we should make those changes with clear minds and hearts. Not in the middle of a stress reaction caused by whatever crazy headline is on the news.

We should fully understand and be fine with the fact that any plans that we have made are going to require some changes over time. We need to be certain that these changes are well thought out and proactive in nature, not reactive.

If you are a couple in your 40’s, remember that your plan needs to work not just for the next 5 months, or 5 years but the next 5 decades.

I opened with the quote from Stephen Covey, “Begin with the end in mind.” Your plan should begin with where it is you want to end up, with your values, your true goals. It is that plan that should lead your decisions, not the news headlines or what the neighbors are doing. Stay true to your own values and goals, in spite of the obstacles laid out before you, and you will find that you will get to where you truly want to be and have enjoyed the journey to get there.