“Change is the only constant in life”

-Heraclitus

“Just because it is being done this way now does not mean it always be done this way.”

When you look out ahead, towards your financial future, there are a few huge expenses you must plan for. For a large portion of people, the cost of raising a child is among the largest expenses to plan for. The single most expensive item in that child’s life is the cost of education, college tuition in particular. There are so many unknowns to plan for. Will my child want to go to college? What type of school will they get in to? How much will it cost by the time they are ready? Now you throw in a whole new set of questions. What if the way we are thinking about that is wrong? What happens if college no longer exists as it does today? How would that change the way people save? We will examine these questions in this week’s Inside Look at Building Towards Wealth.

First, let’s take a look at the facts about the costs of higher education and how people are paying for it.

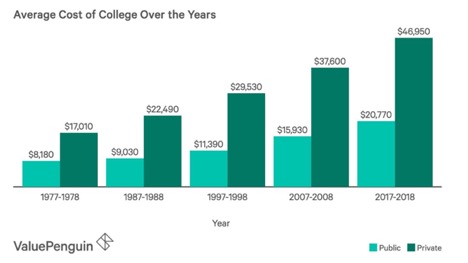

During the 1977-1978 school year, it cost the modern equivalent of $17,010 per year to attend a private college and $8,180 per year to attend a public college. By the 2017-2018 school year, those costs had grown to $46,950 at private colleges and $20,770 at public colleges.

Increasingly, college is becoming too expensive for parents to pay for from income and savings alone. This has led to a spiraling amount of student loan debt being taken on by parents and their children. Often setting them back years in their ability to plan for their own financial future.

Student loans hit $1.41 trillion dollars in 2019 with the average debt being $35,359 and the median debt being about $17,000 according to the Federal Reserve.

Second, what has the current pandemic changed or could change about college moving forward?

On Tuesday, California State University, the largest four-year public university system in the country with 23 campuses and 482,000 students, announced that they intend to go without in-person instruction for most classes in the fall term. This is a signal that the coronavirus pandemic will keep some college campuses largely empty for months to come.

There is a question on how long they will have to shut down classrooms with Mckinsey & Company saying classes will need to be virtual until Fall 2021. I know, as a parent, I would be reluctant to pay tens of thousands of dollars for Zoom classes and a student should question if they want to take on the debt for online learning from an institution not designed to deliver it.

What will happen to universities when revenues nosedive, students are increasingly going to take gap years or take lower-cost local options, and the university expenses remain fixed? What happens when they can have in-person classes but only with limited classroom capacity? Can these institutions survive with decreasing student revenues, states that are strained to fund programs and cut education, and huge fixed costs?

In addition, you have upstarts like Lambda School that have been looking to change the higher education system with very good results.

It has been said for years that something needs to change about the university system. This could be the tipping point that changes everything.

This brings us back to the question, what are we as parents to do in planning for our children’s education? Here there are several options that we should explore.

-529 Plans- A 529 plan is an extremely popular way to save for a child’s college education. You have both prepaid 529 plans and 529 savings plans. I will be focusing on the more popular 529 savings plans.

Money is contributed to the plan, which is then typically invested in mutual funds that are selected from a menu of options in the plan. The contributions may be deductible on state income taxes depending on the state of residence and plan chosen. The performance of those funds will determine how the money grows.

Withdrawals from a 529 savings plan can be used for both college and K-12 expenses. In the case of a 529 savings plan, qualified expenses include tuition, fees, room and board, and related costs.

If you use the funds for reasons other than qualified expenses you will be taxed on any gains and receive a 10% federal penalty on those gains. There are some limited exceptions to this rule.

What else can you do, if you are like me, and you plan on making use of public schools through High School and want to give more flexibility to your money and avoid any penalties?

-Roth IRA- Like the 529, there is no income tax deduction when you contribute to a Roth IRA. Instead, your contributions and earnings grow tax-free. And, because you’ve already paid your taxes, you can withdraw contributions at any time, for any reason, tax-free.

Many families use money from a Roth IRA to pay for at least a portion of their children’s college expenses. The real magic of the Roth IRA happens if you waited until later in life to have kids or you are saving for grandkids.

Once you reach 59½ (and it’s been at least five years since you first contributed to a Roth) all of your withdrawals—earnings as well as contributions—are tax-free. That means 100% of your withdrawals can go to college expenses. If you’re not 59½ yet, withdrawals of earnings will be subject to income taxes, but not an early withdrawal penalty, as long as the cash is used for college expenses.

For 2019 and 2020, you can contribute $6,000-$7,000 if you’re age 50 or older subject to income limitations. That means that over the course of 18 years, you could add up to $108,000, or $216,000 if you and your spouse both contribute to an IRA.

Also, you should consider that money inside a Roth IRA isn’t counted for financial aid purposes. However, withdrawals are counted and that can affect your financial aid package. That’s because withdrawals are counted as income, even though the money isn’t taxed.

-UGMA/UTMA Accounts- UGMA (Uniform Gift to Minors Act) and UTMA (Uniform Transfer to Minors Act) accounts work a little differently. In most states, minors do not have the right to contract and cannot own investments or other assets. For this reason, a trust may be established for the minor and is known as a custodial account.

These accounts aren’t solely intended for education savings as 529 plans are. With a UGMA/UTMA account, there are no limitations on how you can spend the funds from the account when a minor becomes an adult. For parents who are not sure if their child will attend college, or believe they will receive a scholarship, then this type of account may make more sense.

UGMA and UTMA accounts also have no limits on contributions, with contributions being treated as gifts subject to the $14,000 annual gift exclusion. UTMA and UGMA accounts are also tax-advantaged, though not in the same way that 529 plans are.

A bit different to remember when it comes to UGMA/UTMA accounts vs 529s – the beneficiary of an UGMA/UTMA account gains control of the funds when he/she reaches the age of majority. Since UGMA/UTMA’s don’t have any distribution rules, this means upon reaching adulthood, the child gains full control over the account and can spend the money as they choose. Ideally, it would be spent on education-related expenses, but you can’t guarantee that’s how the funds will be used.

Brokerage account- A brokerage account is simply a regular investment account that comes without any special tax breaks. What it does offer is a lot more flexibility than a 529 plan.

You can contribute as much as you want (529 plan contribution limits are much higher than most people will ever need, but they’re not quite unlimited). You can also invest in just about whatever you want.

Most importantly, you can withdraw as much money as you want at any time and for any reason. You won’t be penalized and your earnings will often be taxed at lower capital gains rates.

Put simply, brokerage accounts offer more flexibility than 529 plans, with the trade-off being a lack of tax breaks if the money is used for education.

As with most things in life, there are many different ways to accomplish the same goal. You can also use all of these approaches, and others, simultaneously and create a balanced college funding plan. You should plan carefully and talk to a financial professional before making any final decisions.

I hope this has helped you in your decision on how to save for college and feel free to reach out to me with any questions. My contact is at the bottom of this newsletter.