Over the past 7 months, I have once again taken up CrossFit as my main form of working out. I enjoy that I can regularly push my body to its limits. When I started the workouts, they hurt, a lot, and my times were not very good. I have pulled a couple of lessons from these workouts and want to share them with you in this week’s Inside Look at Building Towards Wealth.

Remaining calm under pressure: One of the reasons I have improved is becoming familiar with the experience of “redlining” or getting close to my physical capabilities and my heart rate is near 100%. If you are not used to this sensation you start to panic, your breathing gets erratic, and your form starts to break down. This can lead to poor performance or injury.

I am now much better at being comfortable with being uncomfortable, something I wrote about HERE. I now know that moment where I feel I might collapse in the middle of a workout, that I am going to be okay and that I can get through it. I have done it a bunch of times. I have worked up to this. I have progressed, no matter what comes at me. I have a good grasp of exactly what my limits are, what my real reaction is going to be, to all of this.

This is also true when it comes to investing. Many people believe they know exactly how things are going to go, they can keep control of their emotions and know exactly how they are going to react in a bad situation. The problem is when the market has a big correction do you have the ability to remain calm under fire? Do you have experience on your side that allows you to remain calm under pressure?

Many people do not. It’s also not your fault. As I have said before

That’s why it often makes sense to work with a professional. They probably have been through it more times than you have and with more people’s money than you have.

Ego is the enemy: In his book, Ego is the Enemy Ryan Holiday breaks down the idea that ego actually stands in the way of many would-be-greats, including ourselves. Ego prevents an individual’s ability to reach their full potential both professionally and personally.

I was reminded of this lesson on my fitness journey. I am not the strongest nor am I the fastest person. If I let ego take over I will try and perform the workouts at the level of the top performers and I will end up either injured or frustrated.

On the flip side, if I let ego take over and only do the workouts that emphasize my strengths and avoid the workouts that contain my weaknesses (anything involving running and gymnastic movements) I will become even more imbalanced and set myself up for other issues.

Ego can also get in our way of reaching our financial goals. We often end up comparing ourselves financially to people portraying themselves as rich. It is not hard to spot rich people. They often go out of their way to make themselves known. But wealth is hidden.

Being swayed by people playing a different game can also throw off how you think you are supposed to spend or invest your money. So much of our actions, particularly in America, are socially driven: subtly influenced by people you admire and done because you subtly want people to admire you.

If we can keep our ego in check and work not only on our strengths but also our weaknesses, our lives and portfolios can be better.

Consistency is better than intensity. Slow is smooth and smooth is fast is a saying in the Navy Seals. It applies to working out and our financial lives as well. If my main workout is going to be 15 minutes long and I go 100% for the first 5 minutes I will not have anything left for the last 10 minutes and will need long breaks sprinkled in.

If instead, I move at a deliberate pace through the workout, I will end up completing more reps by avoiding needing to take long breaks to catch my breath.

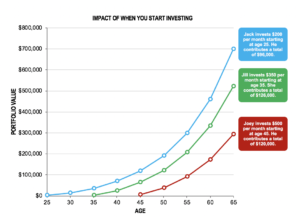

Consistent effort in investing can also pay dividends over the long haul. Some people don’t think that starting with a small amount will amount to much but starting and consistently building on that investment can be the true payoff.

I see this particularly with business owners who are waiting to sell their business to hit that big payday before investing when they could be using their retirement plan to augment what they are doing.

As the above graph illustrates you can be significantly better starting early and remaining consistent over a long period of time versus delaying your savings and investment and trying to make up for it later on. This hypothetical example is used for illustrative purposes only and does not represent the performance of any specific investment(s). Rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of investment risk. The values in this chart do not consider the effect of taxes and/or inflation. Actual results will vary.

Compound interest can really benefit the slow and steady mentality. Consistency over many years can far exceed intensity over a shorter number of years.

Remain calm under pressure, avoid ego, be consistent. Lessons we have all learned and 3 qualities I was reminded of recently on my fitness journey but applicable to so many areas of our life.