Did you know that there could be some major changes coming to the backdoor Roth IRA?

The recent proposed tax changes have gotten a lot of attention in the news lately. This has also spawned quite a few questions from clients and acquaintances. Perhaps the item that raised the most questions is the backdoor Roth IRA.

Let’s take a look at what it is and whether this proposed change will have an effect on your situation in this week’s Inside Look at Building Towards Wealth.

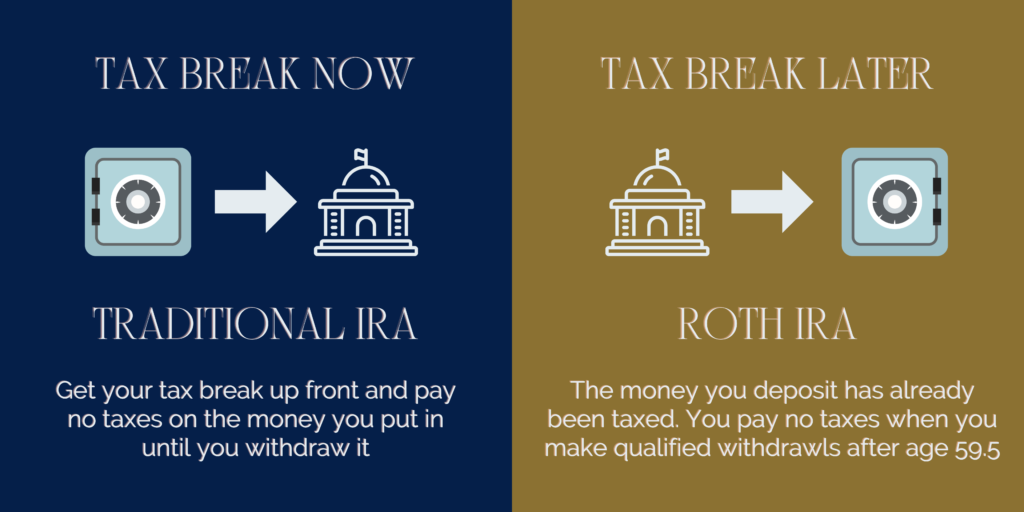

Roth IRA vs Traditional IRA.

Roth IRA funds are deposited with after tax money. The money grows on a tax-deferred basis.

If you are over 59½ and your account is at least 5 years old, withdrawals are tax-free and penalty-free. For those who are under 59½ or do not meet the 5-year rule, special exceptions may apply.

For 2021, you mat have limits to a contribution of $6,000 to a Roth IRA, $7,000 if you are age, 50 and older.

In 2021, if you make over $140,000 of modified adjusted gross income as a single filer, or $208,000 of modified adjusted gross income as a married couple filing jointly, then you are unable to contribute to a Roth IRA.

One planning technique to get around this is the use of a backdoor Roth IRA conversion.

To execute a backdoor Roth IRA, you first must fund your traditional IRA account. Once those funds are in your traditional IRA, you can then convert them to a Roth account.

You should be aware that there are pro rata rules that need to be followed if your IRA currently consists of both before tax and after tax contributions.

Please consult your financial advisor before trying to execute the strategy.

What would change?

The proposal presently on the table would prohibit conversions of after tax dollars in IRAs starting in 2022. This would eliminate the backdoor Roth strategy.

You would only lose the ability to convert after-tax dollars to a Roth IRA. You would still be able to execute traditional pre-tax conversions.

A traditional Roth conversion is where you are converting pre-tax dollars previously deposited into a traditional IRA to a Roth IRA, and paying ordinary income on the amount converted.

Please make note that the funds you put into the Roth are considered converted funds, not contributions. Roth distribution rules would apply.

What should be your plan of action?

This strategy might not make sense for everyone.

An assessment of your current income, as well as your probable future income and considerations about balancing your tax treatment of income in retirement should all be taken into account before determining whether a backdoor Roth strategy makes sense for you.

If you have already been practicing this strategy then it may be wise to do so again this year, as it is still available in the 2021 tax year.

As with any planning technique or strategy. This is just one of many that can help you plan for your financial future.

Removing it from our tool bag does not cripple your ability to plan for the future.

Before you proceed with any financial strategy, i recommend that you consult with a tax, legal or financial advisor regarding your individual objectives and financial situation.

Would you like more information regarding the Roth and Traditional IRA? Check out my blog posts below.

What Everybody Ought to Know About Whether they can Contribute to a Roth IRA

Can You Make a Deductible Traditional IRA Contribution?