Employee Stock Purchase Plans (ESPP), can be an important benefit for clients. These programs can allow the purchase of employer stock at a discount which creates an incentive for employees to increase their ownership stake with their employer. The tax impact upon the sale of…

Read More

Financial Planning

Is Back-Door Roth Going Away?

Did you know that there could be some major changes coming to the backdoor Roth IRA? The recent proposed tax changes have gotten a lot of attention in the news lately. This has also spawned quite a few questions from clients and acquaintances. Perhaps the…

Read More

Home Buying Process: Steps For Home Buyers

The home buying process can be a long process. My wife and I recently went under contract for what is our “forever home.” The home we expect to spend the next two decades in as our 2 young children grow up, go through their formative…

Read More

Dormant 401k: Should I Roll It Over?

Let’s discuss dormant 401k. You’ve left your job and started a new one or you have finally decided to start your own business. What do you do with the old 401k from your previous employer? 401ks and IRAs have many unique features that may benefit…

Read More

Financial Planning for Business Owners

Today’s post is all about financial planning for business owners. A large portion of the financial planning profession is directed at planning for people that have a defined career path. Work a nine to five job, or who contribute money to a 401(k)-plan provided to…

Read More

Financial Planner: 5 Types of People Who Would Benefit Most

Financial Planners can benefit most people. But there are 5 types of people who would benefit most from a financial planner. Let’s take a closer look. “Time is more valuable than money. You can get more money but you cannot get more time” -Jim Rohn…

Read More

SEP vs. SIMPLE IRA for My Small Business?

SEP vs. SIMPLE IRA for you small business? Wondering what you should do? Let’s take a closer look at options. As a business owner, you may be searching for retirement plan options that benefit both you and your employees… all while avoiding burdensome costs and…

Read More

How Much is My Business Worth?

If you find yourself asking the question “How much is my business worth?” Then let’s talk about a few important factors. In my 20 years in financial services, I have spoken to hundreds, perhaps even thousands of business owners. In many of those scenarios the…

Read More

Should I Set Up A Traditional 401(k) For My Business?

Common question I hear is “should I set up a traditional 401(k) for my business? Business owners who are considering a retirement plan for their business have many options. While a traditional 401(k) is a well-known choice for business owners, there are many cases where…

Read More

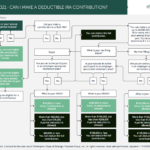

Can You Make a Deductible Traditional IRA Contribution?

Oftentimes, I have many clients come to me and ask, “Can I make a deductible Traditional IRA contribution?” Since this is a common question, I decided to tackle it in this week’s blog post. The following will provide you insights on whether you can or cannot make…

Read More